In Ponzi We Trust

Borrowing from Peter to pay Paul is a scheme made famous by Charles Ponzi. Who was this crook whose name graces this scam?

/https://public-media.si-cdn.com/filer/charles-ponzi-mugshot-631.jpg)

Mug shots of Charles Ponzi, Boston financial wizard, taken during his arrest for forgery under the name of Charles Bianchi. (Bettmann / Corbis)

Editor’s Note, December 19, 2009: In the wake of the scandal surrounding investor Bernard Madoff, Smithsonian looks back at the crook who gave Ponzi schemes their name

John Kenneth Galbraith once observed that “the man who is admired for the ingenuity of his larceny is almost always rediscovering some earlier form of fraud.” Although the details may vary, all flimflam games rely on their basic ability to make a lie look like the truth. Even today, confidence artists continue to work their scams with great success. Time and again, people from every walk of life demonstrate their ability to abandon common sense and believe in something that is simply too good to be true by succumbing to the con man’s call.

Yet when all is said and done, the Internet is merely a vehicle for swindlers to reach their victims. “What is new—and striking—is the size of the potential market and the relative ease, low cost and speed with which a scam can be perpetrated,” FTC Chairman Robert Pitofsky told a Senate subcommittee during a February hearing on Internet fraud. But there is nothing new in the scams themselves: they are the same pyramid schemes, phony business opportunities and phantom storefronts that have been fooling the unwary and greedy for centuries.

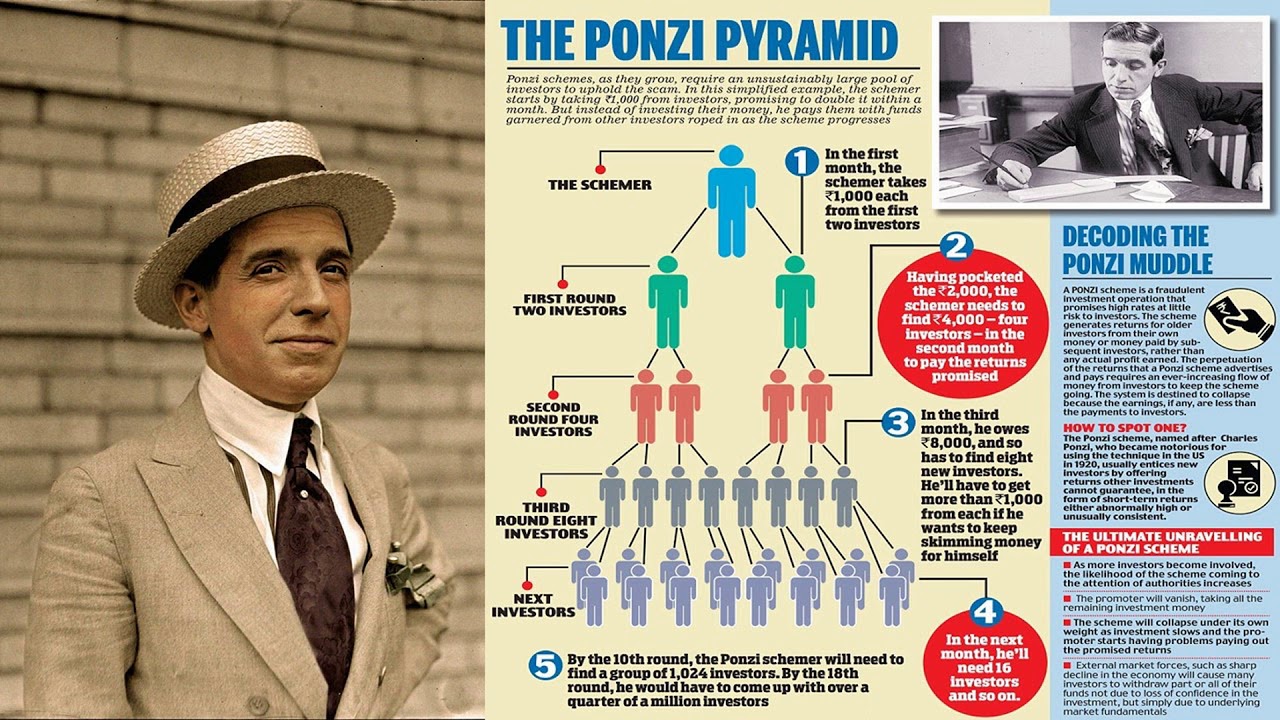

Many of these computer-savvy crooks have taken their cue from an Italian immigrant named Charles Ponzi, a dapper, five-foot-two-inch rogue who in 1920 raked in an estimated $15 million in eight months by persuading tens of thousands of Bostonians that he had unlocked the secret to easy wealth. Ponzi’s meteoric success at swindling was so remarkable that his name became attached to the method he employed, which was nothing more than the age-old game of borrowing from Peter to pay Paul. The rules are simple: money taken from today’s investors is used to pay off debts to yesterday’s investors. Typically, these investors are lured by promises of exorbitant profits—50, even 100 percent. Often, they are coached to recruit more investors to enrich themselves further. The problem is that there is no actual investment going on; the only activity is the shuffling of money from new investors to old ones. Everything is fine until the scheme runs out of new investors and the whole house of cards comes tumbling down.

We still hear about Ponzi schemes, or pyramid schemes, as they are more frequently called. Last year, the collapse of dozens of Ponzi schemes in Albania sparked mass rioting that escalated into a national crisis. And in New York, investors were out an estimated $1.5 billion when the Bennett Funding Group, described by regulators as a “massive, ongoing Ponzi scheme,” went belly-up. On the Internet, a company called Fortuna Alliance promised investors monthly returns as high as $5,000; more than 8,600 people bought into the scheme, which was shut down by the FTC in 1996. Fortuna eventually stipulated to an injunction prohibiting its alleged scam. In January 1998, a judge ordered the company to start paying back its investors. The FTC says it is seeking $5 million in refunds for consumers.

1 Comment

Comments are closed.